After more than two decades in high finance, working with powerhouse firms like Solomon Smith Barney, CitiGroup, and AXA Advisors, Anna Bruno could have built a career defined by numbers and bottom lines. Instead, she chose to redefine success—shifting from product-driven advice to a people-first approach that blends strategy, behavioral finance, and holistic planning. Today, as the founder of AcceleratorCircle® and the Thrive Armenia Foundation, Anna empowers individuals, entrepreneurs, and communities to align their wealth with their values, proving that true success is measured not just in profit, but in the lives we impact along the way.

You’ve spent over two decades in finance—what first drew you to the industry?

I’ve always been fascinated by the way money shapes lives—not just in numbers, but in opportunities, freedom, and choices. Early in my career, I realized that finance wasn’t just about investments or spreadsheets; it was about empowering people to live the life they want. That mix of strategy and human impact pulled me in, and I’ve never looked back.

What inspired you to start your financial planning practice, and what sets it apart?

After working at major firms like Solomon Smith Barney, CitiGroup, and AXA Advisors, I saw how often advice was product-driven rather than client-driven. I wanted to create a practice where people felt truly heard, where their life goals shaped the financial plan, not the other way around. My work combines behavioural finance, in-depth strategic planning, and ongoing accountability, enabling clients to follow through on their goals.

How do you bring a “holistic” approach to financial planning, and why is that important?

Money is never just money—it’s tied to values, emotions, and life events. My holistic approach considers the full picture, encompassing wealth building, tax strategy, legacy planning, lifestyle goals, and even the money mindset. This way, we align financial decisions with the client’s life priorities, which creates both financial growth and personal fulfilment.

You’ve worked with CEOs and corporations as well as individuals—how do those approaches differ?

With individuals, the focus is on personal milestones, such as buying a home, funding education, and planning retirement. With CEOs and corporations, it’s about growth, sustainability, and team impact, such as cash flow optimization, succession planning, and benefits strategies. The common thread is clarity, strategy, and execution, but the scale and stakeholders differ.

What’s a common money myth or mistake you see people make—and how do you help shift it?

One big myth is “I’ll invest when I have more money.” The truth is, waiting is the most expensive mistake you can make—time is your greatest asset. I help shift this by showing clients the cost of delaying, and by breaking big goals into smaller, doable steps so they can start now.

If you’re curious about your financial behaviors, start with my free Money Personality Snapshot. In just a few minutes, you’ll get a quick read on your money strengths and blind spots so you can start making better decisions right away.

If you’d like a more comprehensive, detailed analysis, you can also take my full Money Personality Assessment for $19.95 — it’s an in-depth tool that reveals patterns and opportunities most people never notice, giving you the insights to accelerate your financial growth.

Tell us about the Acceleration Circle—how does it support startups in today’s fast-changing economy?

Acceleration Circle helps entrepreneurs grow their business by combining financial strategy with brand positioning, AI-driven marketing, and operational efficiency. Startups don’t just need funding; they need systems, accountability, and a clear roadmap to scale without burning out. That’s exactly what we provide.

You can learn more about our programs and resources at www.accelerationcircle.com.

What makes the AcceleratorCircle® method unique for helping businesses grow and scale?

It’s a hybrid of financial strategy and business acceleration. We help founders align their business model with their personal financial goals, so they grow profitably—not just fast. Our framework also integrates technology, automation, and high-level mentorship, which means founders spend more time leading and less time putting out fires.

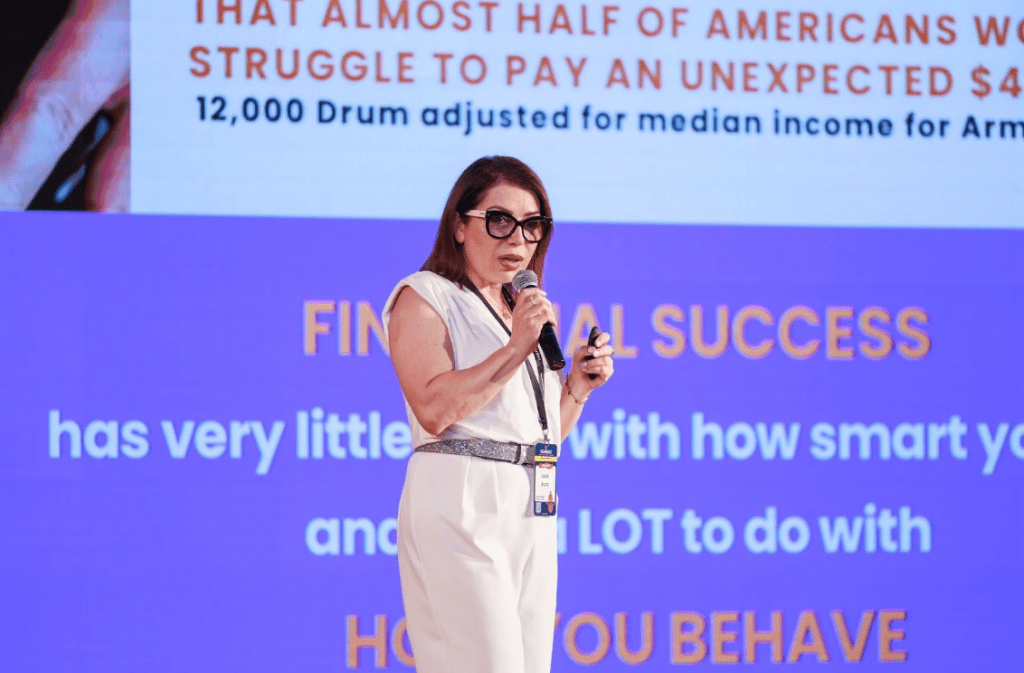

You’ve spoken at some powerful global events—what message do you most love to share with audiences?

I love reminding people that financial freedom isn’t reserved for the wealthy. It’s built by consistent, intentional choices over time. Whether I’m speaking in Dubai, London, or at TEDx Are You Your Job Title or Your Degree? | Anna Bruno | TEDxYerevanSalonmy message is the same: your relationship with money is the foundation for your relationship with your future.

Why was it important for you to create Thrive Armenia Foundation, and what impact are you most proud of so far?

I started the Thrive Armenia Foundation www.thrivearmenia.org to close the opportunity gap. By focusing on skills, jobs, and education, we help people create their own future. My proudest moment? Launching the Get Skills Academy, where displaced individuals and veterans train in tech and entrepreneurship—skills that make them competitive anywhere in the world.

As a mother, business leader, and community advocate—what does success mean to you now?

Success used to mean hitting financial milestones. Now it’s about impact, knowing my work changes lives, my children see me living my values, and my time is spent on what matters most. Wealth is important, but a life well-lived is the ultimate return on investment.

If you’d like to start building your definition of success, I invite you to connect with me through www.accelerationcircle.com or explore your financial mindset with our Money Personality Assessment. https://www.personalityservice.com/portal/CIRC/store