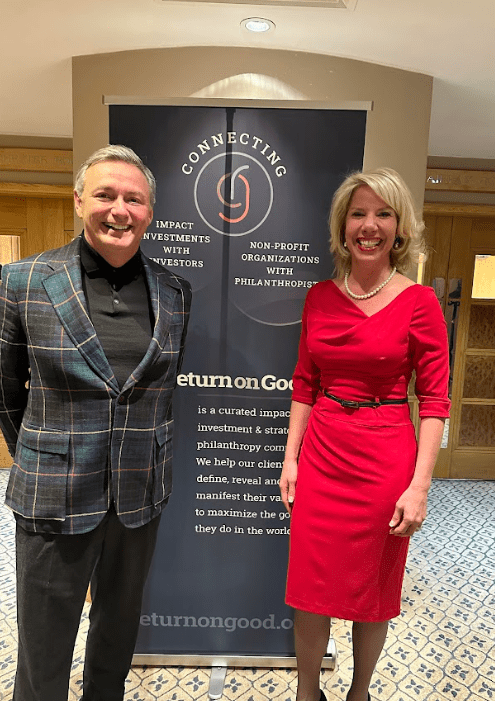

Ann Oleson, an American entrepreneur, CEO, speaker, tech leader, and impact investor, is currently making waves as a partner at Return on Good, an Impact Marketing and Venture Tech firm. With a focus on the family office, accelerator, and venture studio space, Return on Good excels in bringing together impact companies and capital through innovative technology and strategic planning. Ann’s leadership is instrumental in the firm’s primary focus areas: brand activation, capital raise, and sales channel development. Throughout her career, she has built, managed, and grown education, digital, and software companies, showcasing her expertise and visionary approach. Previously, Ann led Converge, a digital agency for education, which achieved recognition on the Inc 5000 list of fastest-growing companies for three consecutive years before a successful exit. Her commitment to innovation and impact is evident in every venture she undertakes. At Return on Good, Ann continues to drive change, leveraging her extensive experience to create meaningful connections and foster growth. Her work is a testament to the power of combining technology with purpose, making her a true pioneer in the impact investment space.

Can you share what initially inspired you to embark on a career in digital innovation and impact investing?

Certainly, we identified a strategic market gap in Higher Education Recruitment Solutions, recognizing an opportunity to pioneer innovation in inbound and digital marketing. This initiative marked a natural progression from our previous endeavors, driven by our foresight into an untapped sector.

Leveraging our established relationships and extensive experience, we cultivated trust with industry partners who collaborated closely with us. Together, we developed comprehensive full-funnel reporting and advanced analytics capabilities, enabling precise ROI measurement.

Following the successful sale of our initial venture, we enthusiastically embarked on a new journey. Our focus shifted towards impact-driven enterprises, aiming to propel their growth through sophisticated digital strategies and dynamic brand activation. Our objective was clear: to facilitate scaling efforts, secure funding, and enhance revenue streams for these forward-thinking companies.

What motivated you to co-found Return on Good, and how does it align with your personal and professional values?

After a successful exit from our initial venture and drawing from our experience within our family office, my partner and I were motivated to co-found Return on Good with a clear focus on aligning our work with our core values: people, purpose, passion, and profits. We sought to concentrate on areas where we excel—activating brands, cultivating relationships, raising capital, and driving sales—believing strongly that supporting entrepreneurs who are positively impacting society represents a win-win opportunity for all stakeholders.

Personally, we are deeply committed to the UN’s 17 Sustainable Development Goals, recognizing a growing investor interest in companies that prioritize social good while delivering financial returns. We are driven by the belief that our efforts can leave a lasting positive impact on the world. At Return on Good, we embrace a culture of hard work, collaboration with exceptional individuals, and the pursuit of meaningful outcomes. By leveraging our strengths and expertise, we are dedicated to empowering more entrepreneurs to make a tangible difference through their endeavors.

How do you define impact marketing, and what unique strategies does Return on Good employ to maximize its effectiveness?

Impact marketing, for us at Return on Good, it about accelerating growth for socially responsible companies. It involves leveraging cutting-edge tools and technologies, such as Hatcher FAAST and advanced analytics, to deliver meaningful and measurable outcomes. These resources enable us to drive results that matter, enhancing our clients’ ability to achieve their business and impact goals.

What sets us apart is our hands-on approach as partners in the firm. Drawing from our own entrepreneurial journeys, including successful exits and scaling ventures, Jay and I bring firsthand experience to every client engagement. This perspective allows us to offer insights and strategies tailored to the unique challenges and opportunities faced by growing enterprises in the impact sector.

Moreover, our extensive network within the family office community and beyond is a significant asset. Over years of relationship-building, we’ve cultivated connections that enrich our clients’ projects with strategic partnerships and investment opportunities. We are selective about the projects we take on, focusing on those where we can leverage our expertise, connections, and partnerships to drive substantial success.

A key element of our approach is the curation of our team. Each partner brings specialized strengths and experiences to the table, ensuring that our clients benefit from a diverse range of perspectives and skills. This collaborative effort is integral to achieving exceptional outcomes and maximizing the effectiveness of our impact marketing strategies.

What challenges and opportunities have you encountered in bringing together impact companies and capital in the family office and accelerator/venture studio space?

Family offices typically have well-established investment theses, often centered around traditional sectors like real estate and proven businesses with generational track records. This can create a hurdle for early-stage startups, particularly those in the pre-seed and seed phases, whose impact-focused missions may not immediately align with traditional financial return models.

One of the primary challenges is shifting the paradigm to demonstrate that impactful investments can also yield meaningful financial returns. At Return on Good, we’ve tackled this challenge by crafting compelling narratives that showcase the dual potential of profitability and positive social impact. By leveraging our extensive network, we connect impact-driven companies with investors who share their values and understand the long-term benefits of sustainable investing.

A standout example of our success in bridging this gap is our collaboration in connecting Tim Tebow with Govo Venture Partners. Tim Tebow’s strong commitment to impact aligns perfectly with their mission. https://www.sportico.com/personalities/athletes/2024/tim-tebow-govo-venture-partners-1234785781/

Among brand activation, capital raise, and sales channel development, which do you find the most challenging and why?

Navigating the complexities of our business involves a critical focus on facilitating fundraising for pre-seed, seed, and Series A companies. Success hinges on aligning the entrepreneur, their venture’s potential, and compelling narrative with investor theses, particularly those of family offices.

Throughout 2023, capital deployment has posed a significant challenge, reflecting a broader trend in venture capital. Global VC funding saw a marked decline of 38%, with the U.S. experiencing a notable reduction across all stages of funding. Late-stage investments, for instance, dropped to a median of $100 million from $150 million in 2022. This shift underscores investor preference for lower-risk opportunities and established track records.

Reflecting on your career, including the successful exit of Converge and your role as the first female sales leader at Stamats, which accomplishment are you most proud of?

I take great pride in pioneering innovation within Higher Ed through Converge. We launched with a vision, secured initial funding, and were driven by the belief that digital and inbound marketing could revolutionize college recruiting. As HubSpot’s inaugural Value Added Reseller in education, we became thought leaders, presenting at numerous industry conferences and introducing advanced analytics to university admissions.

Equally, I am immensely proud of our team’s contributions. Their dedication enabled us to achieve Inc. 5000 recognition for three consecutive years before our successful exit. Starting a business is one achievement, but delivering exceptional customer experiences that yield tangible results and enable scalable growth in a service-based industry is testament to our team’s prowess. We recruited and nurtured a remarkable team of achievers who were integral to our success.

How have the various awards and recognitions you’ve received influenced your career and leadership style?

While awards serve as recognition for hard work and achieving milestones, I find the most satisfaction in setting ambitious goals and surpassing them alongside my team. Cultivating talent and fostering growth is a personal passion of mine, recognizing that exceptional teamwork is indispensable to delivering outstanding results.

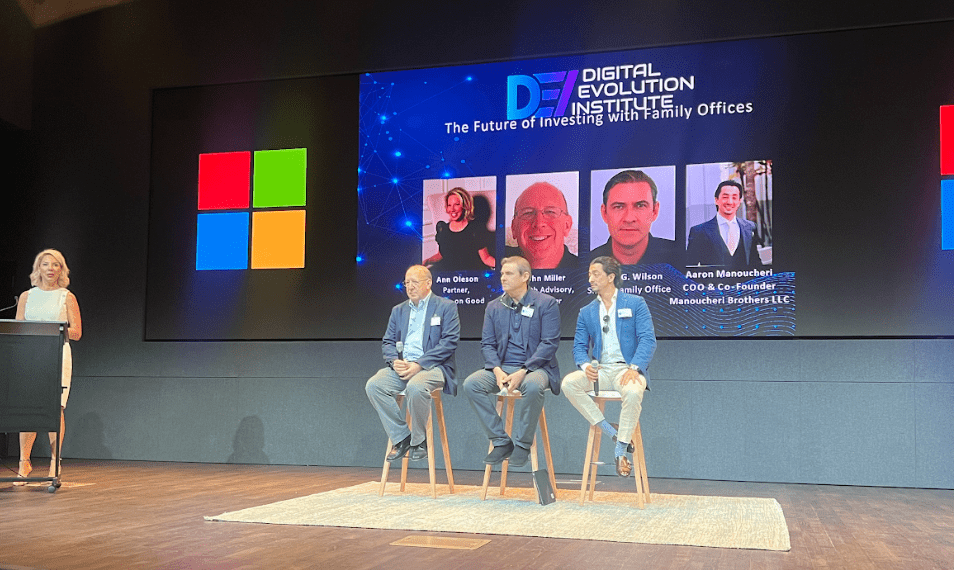

As a frequent presenter and panelist, what key messages do you aim to convey about impact marketing, venture tech, and the modern family office?

Investing wisely enables the alignment of People, Purpose, Passion, and Profit within a company. For family offices, early education of children in business philosophy, investment thesis, philanthropic endeavors, and goals is crucial. Technology serves as a catalyst for innovative ideas and effective strategies, emphasizing continuous learning, engagement, experimentation, and leveraging technology to elevate outcomes from good to exceptional.

How has your experience serving on boards and committees, such as Junior League and United Way, shaped your approach to business and community engagement?

Throughout my career, I’ve had the privilege of serving on various boards spanning non-profit, educational, civic, and national organizations. Each board position has been immensely fulfilling, offering the opportunity to drive impact and achieve organizational goals through effective governance. I have cherished every role and believe that while non-profits and for-profit entities operate differently, there is invaluable learning to be gained—from the diverse scales and scopes to the leadership styles of different CEOs.

Splitting your time between New York, Miami, and London, how do you manage to maintain a balance between your professional commitments and personal life?

Oprah once said, “You can have it all, just not all at once.” In my own journey, I’ve adopted a focused approach by prioritizing up to three key areas at any given time: my family, my work, and my commitment to service. This deliberate focus allows me to allocate my energy where it matters most, while confidently deferring other interests with a clear “Not yet,” knowing they will have their time in the future.